As of September 30, more than 374 real estate enterprises nationwide issued bankruptcy announcements in 202020. most of the reasons for bankruptcy were inability to pay off debts. On the other hand, in the first eight months of this year, the number of regulation and control of the domestic real estate market reached 368 times, and small and medium-sized housing enterprises faced greater operating pressure, which was inevitable for the industry reshuffle.

More than 374 housing enterprises went bankrupt,

guangdong accounts for more than 16%

according to the public information of the People's Court announcement network, from January to September 2020, more than 374 real estate enterprises with the name of "real estate" issued bankruptcy announcements, mainly small and medium-sized enterprises, among them, there are more than 60 bankrupt housing enterprises in Guangdong, accounting for more than 16%, which is the province with the largest bankruptcy of housing enterprises so far this year.

(Image Source: kitchen and bathroom headlines, invasion and deletion)

several bankruptcy documents show that financing difficulties are the main reason for the bankruptcy of housing enterprises. In bankruptcy housing enterprises, the assets of many enterprises are auctioned, and some enterprises are reorganized under the leadership of the court and the participation of interested parties. There are also enterprises that are insolvent and have no property to distribute. For example, Henan Longcheng Real Estate Development Co., Ltd., which issued the bankruptcy announcement on September 30, the latest record of breach of credit shows that all the loan principal 4.2 million yuan and interest payable have not been fulfilled.

In addition to the problem of arrears, the tightening real estate control policy also puts pressure on the operation of housing enterprises. According to the statistics of Central Plains Real Estate Research Center, the cumulative number of domestic real estate regulation and control reached 32 times in August this year, and the cumulative number of regulation and control reached 368 times from January to August. In September, many more popular cities introduced new real estate control policies. According to some analysis, the first half of 2020, the most relaxed real estate regulation, has passed, and the tightening of regulation is inevitable, which will bring great pressure on the sales targets of various housing enterprises and force them to change their operation and sales strategies, small-scale housing enterprises are easy to "fall behind" or even be eliminated by the market at this time.

In the first half of the year, the first housing enterprise was not easy.

Affected by the epidemic this year, many real estate enterprises have not reached the sales target in the first half of the year. While small and medium-sized housing enterprises have successively gone bankrupt, large housing enterprises are also having a hard time.

The most famous example is Fusheng real estate. The 0.1 billion-yuan equity of Fujian Fusheng Qianlong Real Estate Development Co., Ltd. held by the company was frozen before, from September 14, 2020 to September 13, 2023, it shall be executed by the People's Court of Chongming district of Shanghai. On March this year, the suppliers of Fusheng group couldn't find pan Weiming, the chairman of the board, and filed a complaint to the court. At present, Pan Weiming's trend is still a mystery.

In addition, the "report" of Evergrande Group requesting Guangdong provincial government to support its major asset restructuring project was published online in September this year. When the interest-bearing liabilities of Evergrande Group reached 835.5 billion yuan, although Evergrande group later issued a statement referring to the fabrication and slander of relevant documents and screenshots, the high debt problem of large housing enterprises still became the focus of the industry.

(Image Source: kitchen and bathroom headlines, invasion and deletion)

in fact, Evergrande put forward the development strategy of "high growth, scale control and debt reduction" earlier than March this year, striving to reduce interest-bearing liabilities by an average of 150 billion yuan per year from 2020 to 2022. Pan Darong, chief financial officer of Evergrande, said in the mid-term performance conference at the end of August that Evergrande's interest-bearing liabilities decreased by about 40 billion yuan at the end of June compared with that at the end of March, and he was confident that interest-bearing liabilities and net debt ratios would drop sharply at the end of June.

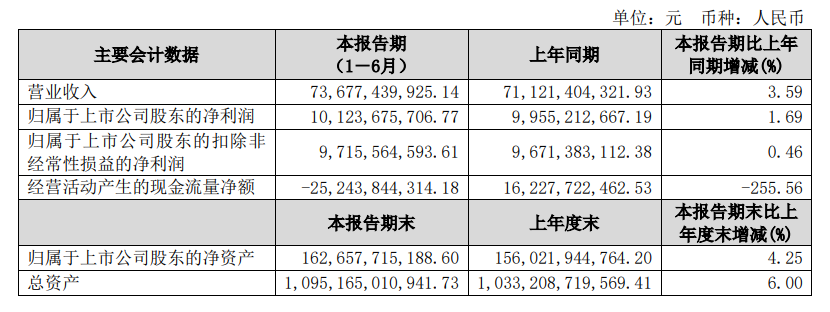

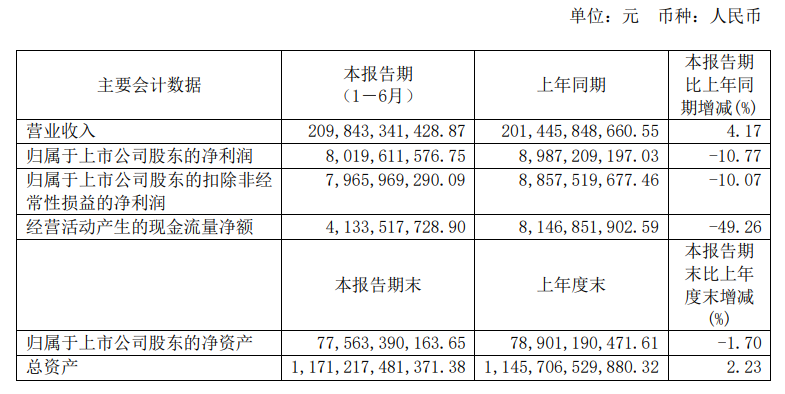

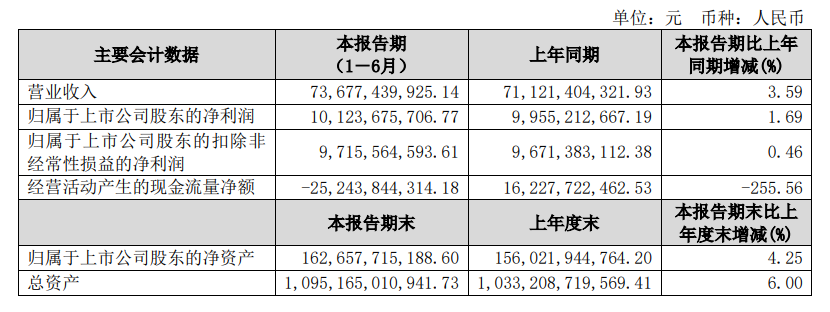

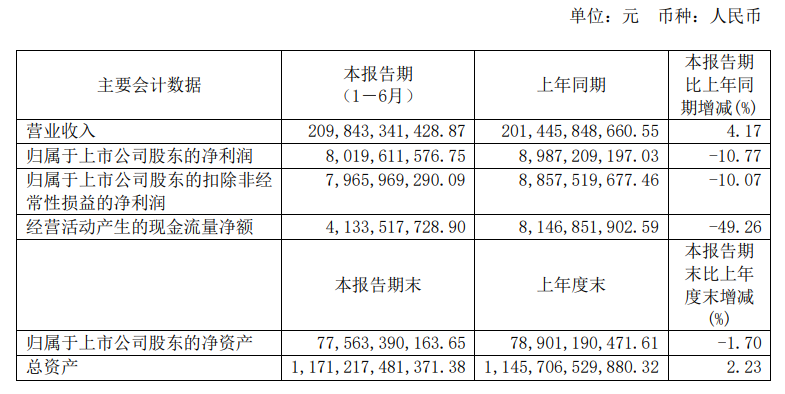

In addition, the reduction of net operating cash flow revealed in the recent performance reports of several head housing enterprises also reflects that the operating conditions of these housing enterprises are worse than the same period last year. For example:

poly Real Estate's net operating cash flow decreased by 255.56% to a negative number from January to June, which was-25.244 billion yuan.

(Image Source: kitchen and bathroom headlines, invasion and deletion)

from January to June, the net cash flow of Country Garden declined sharply from 1.808 billion yuan in the same period last year to-16.072 billion yuan, which also changed from positive to negative.

(Image Source: kitchen and bathroom headlines, invasion and deletion)

greenland Holdings's net cash flow decreased by 49.26% to 4.134 billion yuan from January to June, which was only about half of the net profit in the same period.

(Image Source: kitchen and bathroom headlines, invasion and deletion)

when the net value of operational cash flow is significantly lower than the net profit for a long time, the industry often regards it as an early warning signal for enterprises. Under normal circumstances, factors such as the decline of sales return rate and the increase of enterprise inventory will affect the operating cash flow of the enterprise. At the same time, the expansion of production, the purchase of commodities, the development of new products and so on will also lead to the decline of operating cash flow. If the index of an enterprise declines continuously or becomes negative for a long time, attention should be paid to it.

The proportion of bulk business has increased,

household enterprises beware of "stepping on Thunder"

in recent years, with full decoration and fine decoration becoming the standard of the real estate industry, downstream suppliers spend more energy on engineering channels, and the proportion of bulk business income in total revenue of some enterprises continues to rise. Take del floor (Del future) as an example. Even affected by the epidemic, the number of contracted domestic engineering Channel floor projects and strategic customers in the first half of Del floor increased by 30% year on year, it shows a good momentum of development.

A lot door and window enterprises also regard the engineering channel as an important channel to expand their business. However, as the proportion of engineering channel revenue continues to increase, the problems of enterprises focusing on product delivery and sales collection are also increasing. As there are as many enterprises entering and exiting the real estate industry, it is possible to "step on the Thunder" accidentally, and the downstream enterprises cannot collect the project funds due to the rupture of the capital chain of the real estate enterprises. The reshuffle of the real estate industry continued. In the first nine months of this year, there were more than 374 bankrupt housing enterprises, and it is expected that there will be more than 400 in the whole year. This also reminds door and window enterprises that they should be more cautious when bidding for upstream housing enterprises, the improvement of risk control ability should also be put on the agenda.

(Article Source: kitchen and bathroom headlines, invasion and deletion)