In the second half of 2020, the epidemic has not completely ended, but another big news comes: as a practitioner in the home building materials industry, we are very sorry to inform you:

the price is really going to rise. At present, I have received preset price notices from many factories.

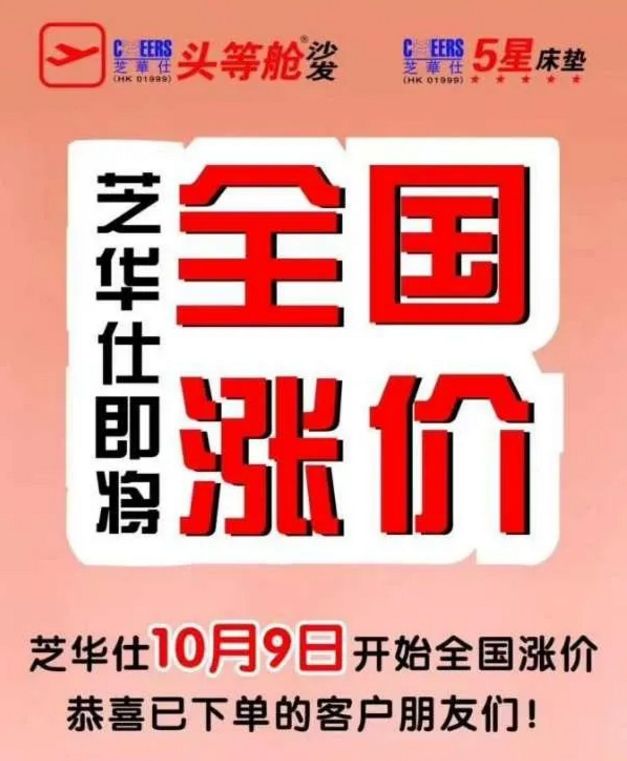

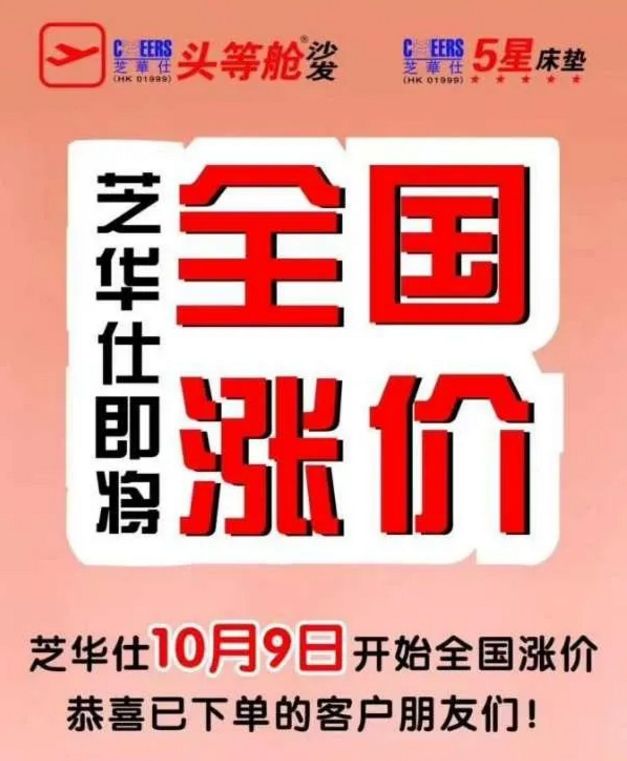

CHEERS announced the national price increase

(Image Source: China whole wood network, invasion and deletion)

chivas furniture announced a nationwide price increase from October 9th!

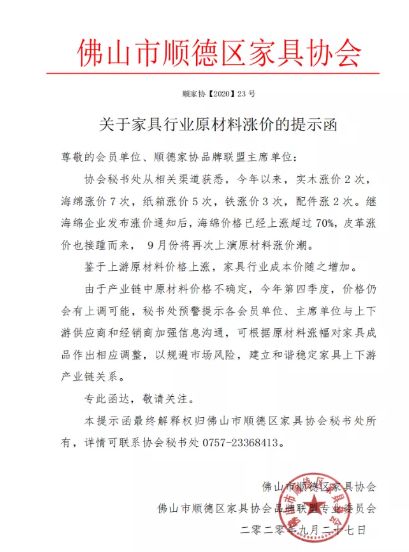

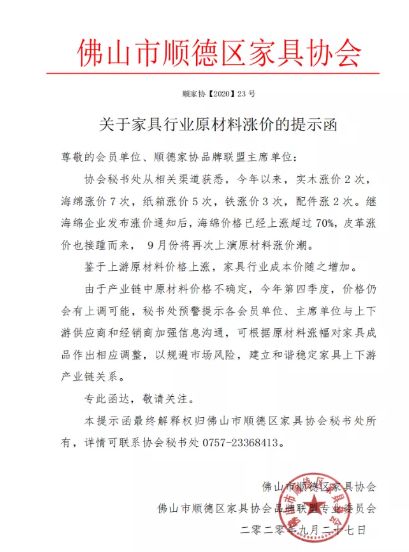

Shunde released a reminder letter on the price increase of raw materials in the furniture industry

on September 27, the reporter learned from the public Number of Shunde Furniture Association that due to the uncertain price of raw materials in the industrial chain, the price may still be raised in the fourth quarter of this year.

(Image Source: China whole wood network, invasion and deletion)

in addition to furniture, since entering the second half of the year, all walks of life in China have entered the "price increase tide" almost at the same time, coal, steel, cement, sandstone, chemical industry, ceramics, sanitary ware, glass, the prices of paper making and other products have risen across the board, and even some raw material products have been closed and out of stock. The whole market is booming.

Coking coal futures rose 28.3 percent in 5 months

it is reported that the price of coking coal futures rose from 1002 yuan per ton on April 29 to 1286 yuan on September 23, up in five months.

The "Golden nine silver ten" of the market has driven the market to turn better. The demand of cement, chemical industry, steel, ceramics and glass industry has picked up. Industrial enterprises are rushing to catch up with the construction period and use electricity to recover; Superimposed coal winter storage and pulling for transport, driven by the strong recovery of coal demand in the last few months of this year, coastal coal cities ushered in a three-high demand for supply and transportation.

Coal prices rose more than 600 yuan/ton to stop sales in some areas at the gate

in the middle and late September, the state coal mine safety supervision bureau requested 11 provinces (autonomous regions and municipalities directly under the central government), including Shanxi, Inner Mongolia, Heilongjiang, Shandong, Henan, Hunan, Chongqing, Sichuan, Guizhou, Yunnan, Shaanxi, etc. To carry out comprehensive supervision, some coal mines in Yulin, Shaanxi province stopped production and sales, and users such as chemical industry, cement and winter heating coal were actively purchasing. Most coal mines were in line with coal pulling trucks, with low inventory and tight coal supply, the price rise in the later period has strong support.

Although the load of civil electricity in the south decreased after the weather cooled down, after the production of cement, chemical and other terminal peaks, the construction started to pick up and the demand for non-electricity consumption coal improved. In addition, with the increasing expectation of cold winter gas, power plants in northern China began to increase the procurement of winter storage, and the railway increased the capacity of direct power plants, which affected the resources flowing to the Bohai Sea Port. The market support factor is relatively strong, and the market is prone to rise and fall in in stock.

Judging from the current hot market of Yulin mines, there is no recession, no obvious increase in the supply side of the port, and the continuous expansion of the demand side, which can also indicate that the peak price increase of the origin has not passed.

It is understood that the price of nearly 30 coal mines in Yulin, Shaanxi province has been raised by 5-10 yuan/ton. In the case that the country does not release imports, last weekend, the price of coal in the port market rose over 600 yuan/ton.

National coal mines and overload inspections, limited release of coal mine output, replenishment of surrounding power plants and Coke Enterprises, rising demand for downstream coal, winter coal reserve in civil market, and improvement of "Golden nine silver ten" building materials market, adding the pull of economic recovery on the demand for steel bars, cement, etc., as well as the contraction policy of imported coal, etc., therefore, the rise of coal price is logical.

Steel up by 247 yuan/ton

in the first half of 2020, the domestic steel industry as a whole went out of the "deep V" trend. At the end of August, compared with the beginning of the year, the cold-rolled coil a ton rose by about 180 yuan, and the hot-rolled coil a ton rose by about 140 yuan. The billet price once hit the integer pass of 3500 yuan, and the current price returned to the rising trend during the driving period, and the trading atmosphere warmed up again.

Hot rolled coil plate: the average price of 5.5mm hot rolled coil plate in 10 key cities in China is 4028 yuan/ton, up 43 yuan/ton from last weekend and 63 yuan/ton from the same period last month. Cold Rolled Coil: the average price of 1.0mm cold rolled coil in 10 key cities in China is 4657 yuan, up 102 yuan/ton from last weekend and 247 yuan/ton from the same period last month.

Moderate thickness plate: the price of 20mm medium board in 10 key cities in China is 3990 yuan, up 31 yuan/ton from last weekend and 46 yuan/ton from the same period last month.

Chemical products generally rose, and even there was a seal without quotation.

In terms of chemical products, many chemical products have generally risen recently, and even there has been a situation of closing the plate without quotation. On September 23, Shi Da, the leading enterprise of dimethyl carbonate (DMC), raised the price of 1000 yuan/ton again SH, and reported a high price of 15000 yuan/ton, all of which were sold separately.

On September 22, the domestic price of dimethyl carbonate (DMC) rose another 10.57% to 13600 yuan/ton, and the mainstream transaction price in the market reached between 13500 yuan and 13900 yuan per ton, reaching a new high in nearly three years. At present, the supply of dimethyl carbonate in the field is tight. After the orders are mostly placed on the National Day holiday, taking into account the profit factor, the owner of the goods is mostly closed to the outside world, and the order is carefully received.

Titanium dioxide rose more than 600 yuan/ton, sealed and out of stock

in September Panzhihua, the price of titanium ore increased significantly. As of September 25, the price of 46 grade 10 ore in Panzhihua was 1500-1550 yuan/ton, compared with the beginning of the month, there was an increase of more than 150 yuan/ton. Relevant industry insiders said that at present, leading enterprises are ready to continue to raise prices after the national day. I heard that existing enterprises plan to push up 1000 yuan/ton again.

Propylene oxide hit a 12-year high

on September 25, the price of propylene oxide was 18300 yuan/ton, up 450 yuan/ton from 17333.33 yuan/ton at the beginning of the week, up%, and up 34.34% in the past 30 days, the lower point soared by 165.7%. It hit a new price since July 2008.

Dimethyl carbonate is 175% higher than the lowest value this year.

On September 24, the price of domestic dimethyl carbonate was 13200 yuan/ton, reaching a new high in nearly three years, up% from 10500 yuan/ton in the previous week, compared with the lowest value of this year, 4800 yuan/ton rose 8400 yuan/ton, up 175%. At the beginning of August this year, dimethyl carbonate still fluctuated around 6,000 yuan/ton. In less than two months, the price increase of this product has doubled.

The lowest point of Polyether in the year soared by 186.8%

in September, the price of soft foam Polyether continued to rise. As of the 24th, it had set a new height in history. The soft foam scattered water was sent to East China at 20,000 yuan/ton or more, which was nearly 3,000 yuan/ton higher than that on September 18. The highest price of soft foam Polyether in Shandong and North China was 19500 yuan/ton on the 24th, up% from the same period last year and 6800 yuan/ton from the lowest point on April 4, up%.

(Article Source: China whole wood network, invasion and deletion)