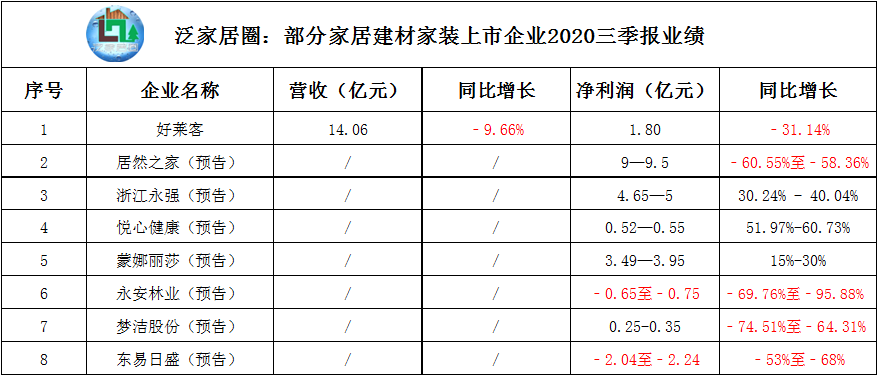

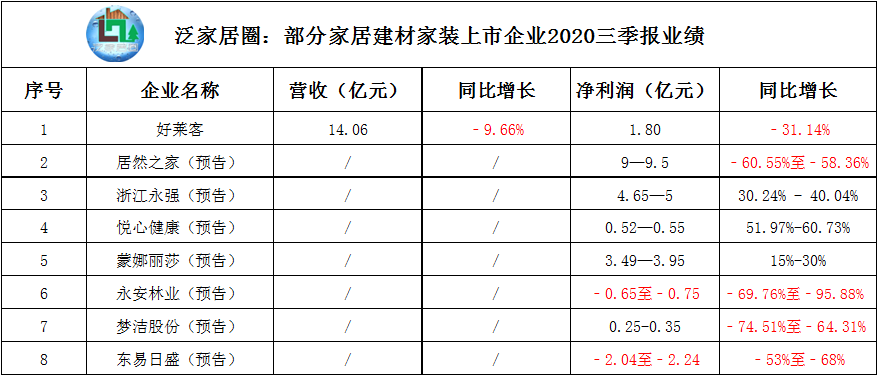

Recently, listed home furnishing enterprises have successively announced their third-quarter financial reports and forecasts, including haolaike, Juran home, Dongyi Risheng, Mona Lisa, Mengjie shares, Yongan Forestry, Zhejiang Yongqiang, home furnishing enterprises, including Yuexin health, have disclosed the third-quarter financial report. Next, let's take a look at the specific performance of these enterprises in the third quarter?

(The picture comes from the creative idea of taking a letter, invasion and deletion)

(Source: Pan home headlines, invasion and deletion)

note: the organization of pan-home circle is related to the third-quarter financial report of listed enterprises.

[Three quarterly reports]]

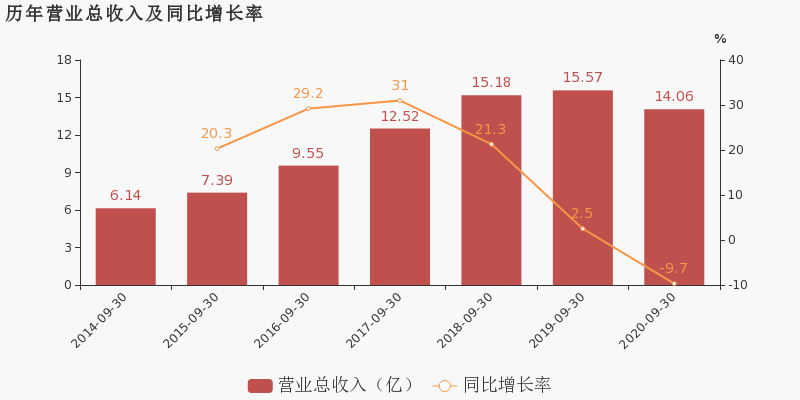

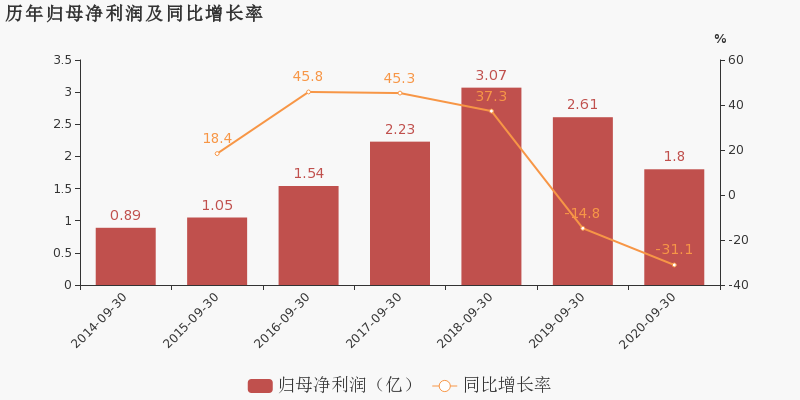

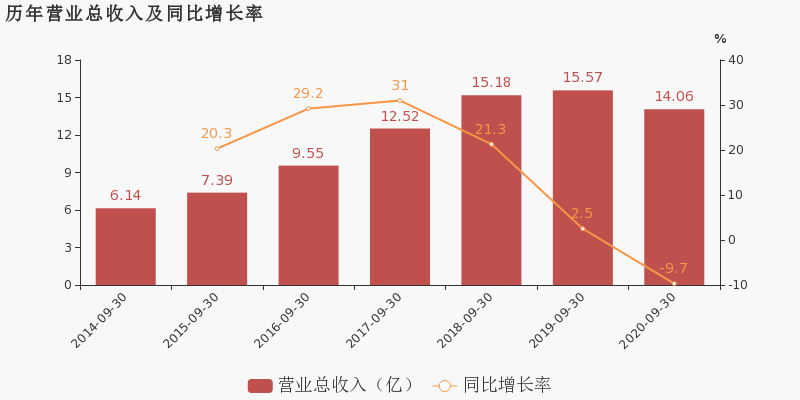

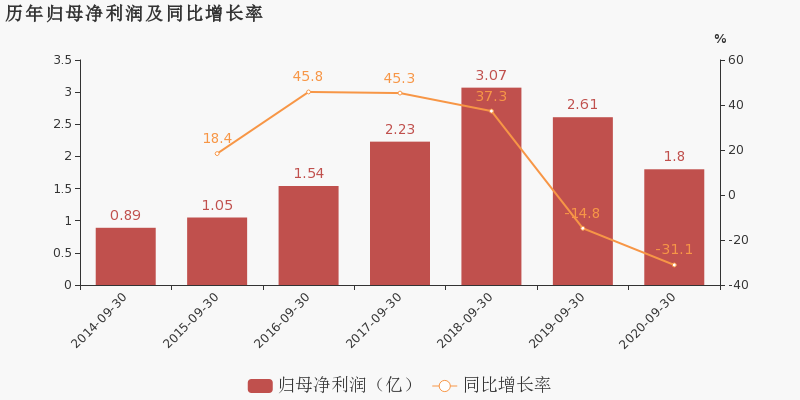

1. Haolaike's net profit in the first three quarters of 2020 decreased by 31.14 percent year-on-year

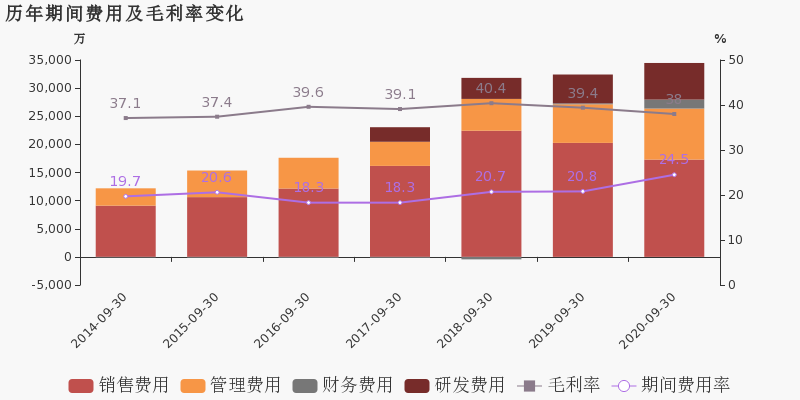

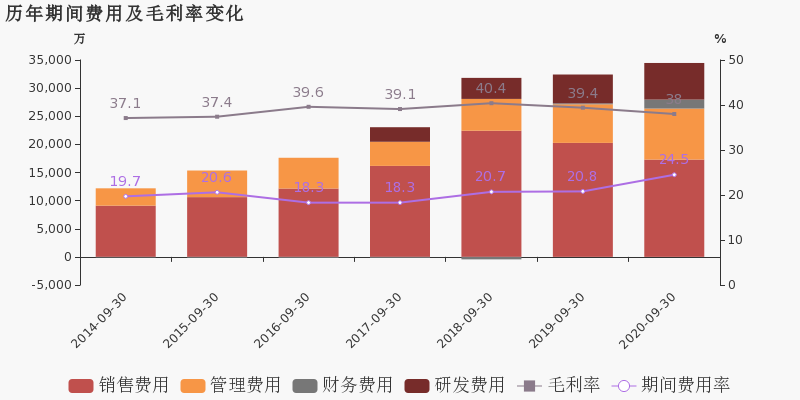

on October 16, haolaike disclosed its third quarterly report in 202020. in the first three quarters of 202020, the Company achieved gross trading income 1.406 billion, a year-on-year decrease of 9.66%; The net profit of the parent was 0.18 billion, a year-on-year decrease of 31.14%, the decline increased compared with the same period last year; Earnings per share was 0.59 yuan. During the reporting period, the gross profit margin of the company was 38 percent, down 1.3 percent age points year-on-year, and the net interest rate was 12.2 percent, down 4.1 percent age points year-on-year.

(Source: Pan home headlines, invasion and deletion)

(Source: Pan home headlines, invasion and deletion)

the announcement showed that haolaike's operating cost in the third quarter of 2020 was 0.87 billion, down 7.7 percent year-on-year, lower than the decline rate of 9.7 percent of operating income and 1.3 percent lower gross profit margin. During the period, the expense rate was 24.5 percent, up 3.7 percent from the previous year, which was a drag on the company's performance.

(Source: Pan home headlines, invasion and deletion)

[Three-quarter forecast]]

1. Dongyi Risheng expects the net profit of the parent in the third quarter to increase by 130% year-on-year to 160%

on October 14, Dongyi Risheng (002713) announced that the company's net loss attributable to shareholders of listed companies in the first three quarters was 0.204 billion yuan to 0.224 billion yuan, down 53% to 68% year on year, the loss per share is 0.49 yuan to 0.53 yuan. Among them, the company's net profit attributable to shareholders of listed companies in the third quarter was 22 million yuan to 42 million yuan, a year-on-year increase of 130% to 160%, and earnings per share were 0.05 yuan to 0.1 yuan, in the same period of last year, the net loss of mother was 71.3207 million yuan. (Zhitong Finance and Economics)

2. The net profit of Mengjie shares in the first three quarters was 25 million yuan-35 million yuan, down 74.51%-64.31% year-on-year.

On October 14, the performance forecast of Hunan Mengjie Home Textile Co., Ltd. for the first three quarters of 2020. The announcement said that in the first three quarters of 2020, the net profit attributable to shareholders of listed companies was 25 million yuan to 35 million yuan, down 74.51%-64.31% from the same period last year, basic earnings per share: 0.03 yuan/Share-0.05 yuan/share. In the third quarter, the net profit loss attributable to shareholders of listed companies was 20.7229 million yuan-10.7229 million yuan, and the basic earnings per share loss was 0.03 yuan/Share-0.01 yuan/share.

3. Yongan Forestry's highest loss in the first three quarters was 75 million yuan

on October 14, Yongan Forestry announced the performance forecast for the first three quarters up to September 30, 202020. The report shows that the company is expected to lose 65 million yuan-75 million yuan in the first three quarters, down 69.76%-95.88% year-on-year. Yongan Forestry said that the main reason for the decline in performance was that timber production was still in a state of limited cutting under the influence of relevant national policies, with low production and sales. In man-made Board, furniture and household products were affected by the epidemic, and the market demand at home and abroad dropped sharply, with low production and sales.

4. Channel marketing sinking Mona Lisa's net profit in the first three quarters is expected to increase by 15%

on the evening of October 13, Mona Lisa released the performance forecast for the first three quarters of 2020. It is estimated that the net profit attributable to shareholders of listed companies in the first three quarters is 0.349 billion yuan to 0.395 billion yuan, an increase of 15%-30% over the same period last year. According to the announcement, the company's net profit attributable to shareholders of listed companies in the third quarter is expected to be 0.153 billion-0.167 billion yuan, an increase of 10-20% over the same period last year. As for the performance growth, Mona Lisa said that the company had taken a series of measures to deal with the impact of the epidemic, rapidly resuming production and recovering production capacity. In addition, channel marketing business continued to implement the sinking strategy, optimized the existing sales network, and plus-sized the layout of county-level market nationwide. (Gronghui)

5. Yue Xin health: net profit in the first three quarters increased by 51.97%-60.73% year-on-year

on October 13, Yue Xin health (002162) released the performance forecast for the first three quarters of 2020. The company expects to achieve a net profit of 52 million yuan to 55 million yuan attributable to shareholders of listed companies in the first three quarters, year-on-year growth of 51.97%-60.73%; Expected third quarter earnings of 28.59 million yuan-31.59 million yuan, an increase of 45.13%-60.36% over the same period last year. (China Securities News · China Securities Regulatory Commission)

6. Zhejiang Yongqiang's expected profit in the first three quarters is 4.65-0.5 billion yuan

on October 12, Zhejiang Yongqiang updated the company's performance forecast for the first three quarters. According to the announcement, the company made a profit of 0.465 billion yuan to 0.5 billion yuan in the first three quarters, an increase of 30.24% to 40.04% over the same period last year. Zhejiang Yongqiang explained that due to the impact of the new coronavirus epidemic, people choose to live at home more, and e-commerce shopping channels are more popular with the public, resulting in a significant increase in the demand for home garden leisure products in overseas markets. It is worth noting that Zhejiang Yongqiang securities investment business did not perform as expected in the third quarter, with a loss of about 0.13 billion yuan. (Interface News)

7. The estimated net profit of Juran home in the first three quarters of 2020 is 0.9 billion ~ 0.95 billion yuan.

On September 24, Juran home released a performance forecast. It is estimated that the net profit attributable to shareholders of listed companies in the first three quarters of 2020 is 0.9 billion yuan to 0.95 billion yuan. Due to the impact of the epidemic, merchants have adopted rent reduction, support measures such as rent-free have led to a decrease of about 58%-60% in profits in the first three quarters of this year compared with the same period last year. Basic earnings per share: 0.15 to 0.16 yuan. It is estimated that the net profit attributable to shareholders of listed companies in the third quarter of 2020 will be 0.493 billion yuan to 0.543 billion yuan, and the basic earnings per share will be 0.08 to 0.09 yuan. The semi-annual report of 2020 shows that the main business of Juran home is leasing and joining management service industry, commodity sales industry and decoration service industry, accounting for%,% and% of revenue respectively. (Daily Economic News)

(Source: Pan home headlines, invasion and deletion)