Recently, another pan-household enterprise, Zhongtai, has changed its IPO review status to "termination (withdrawal)". According to its prospectus, in 2021, China-Thailand design revenue was 0.413 billion, and the balance of accounts receivable was 0.368 billion, accounting for 89 percent.

On April 25, 2022, China-Thailand design submitted to Shenzhen Stock Exchange the application of Sichuan China-Thailand Joint Design Co., Ltd. for withdrawing the initial public offering of shares and listing on the gem. The sponsor submitted to Shenzhen Stock Exchange the application of Dongguan Securities Co., Ltd. for withdrawing the initial public offering of shares of Sichuan Zhongtai United Design Co., Ltd. and listing on the gem. According to the relevant provisions of Article 67 of the review rules for the issuance and listing of stocks on the Growth Enterprise Market of Shenzhen Stock Exchange, Shenzhen Stock Exchange decided to terminate the review of the initial public offering of stocks designed by China and Thailand and listing on the growth enterprise market.

Zhongtai design is mainly engaged in creative design consulting and full technical services related to architectural design, and has grade a qualification in the construction industry (construction engineering), can engage in all relevant architectural engineering design and consulting services within the scope of qualification certificate, including conceptual design, scheme design, preliminary design, construction drawing design, construction coordination and later service, etc. The company's business mainly focuses on residential building design and public building design, covering Industrial New Town, urban renewal, Cultural Travel Town and other fields.

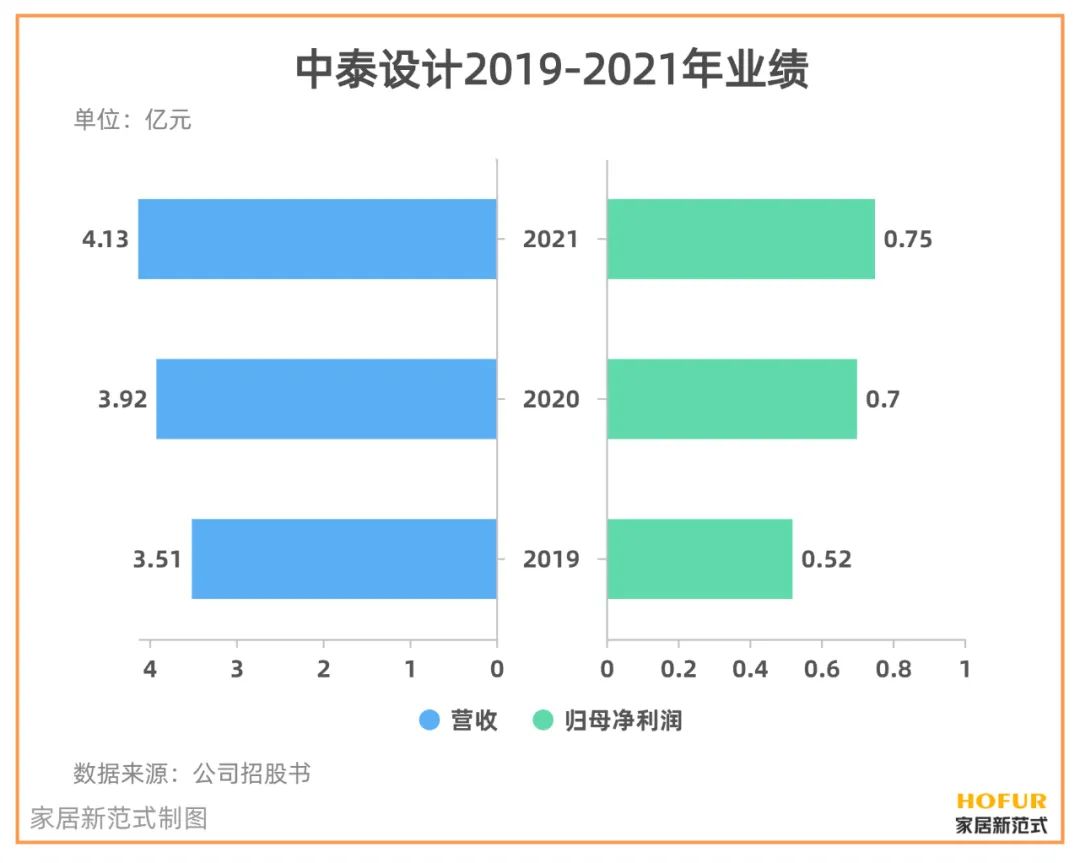

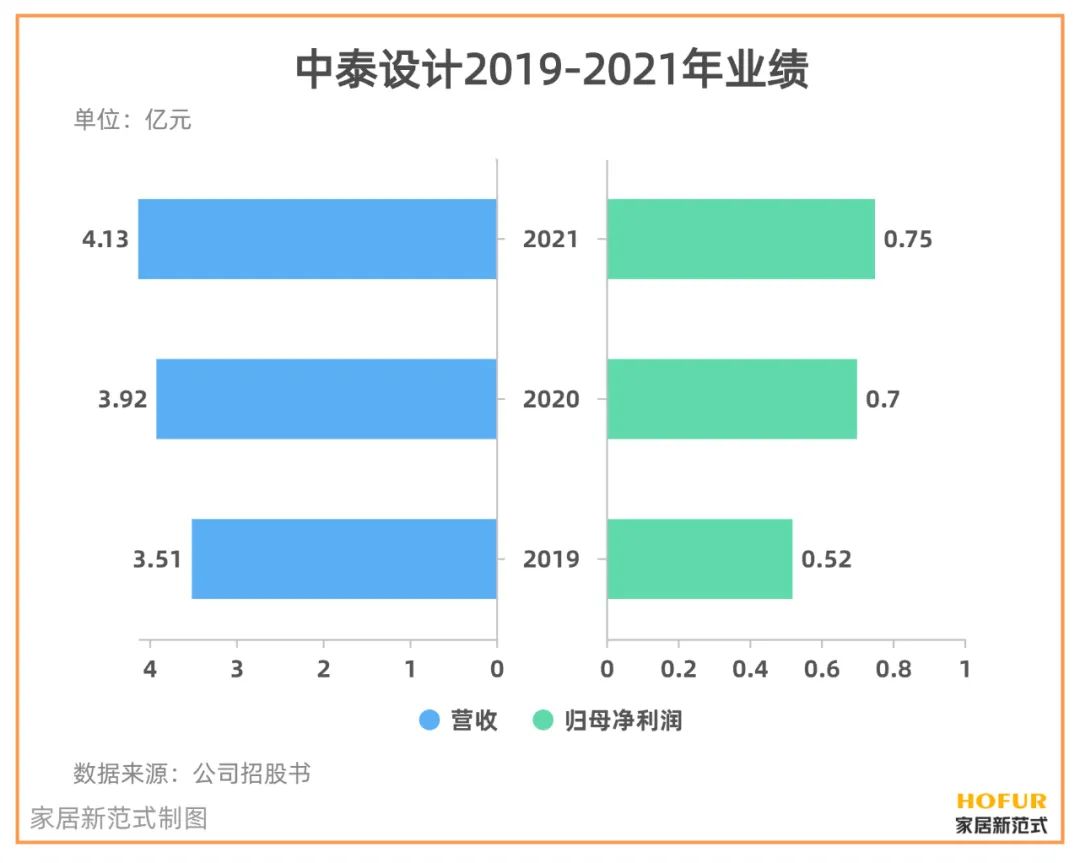

As a well-known architectural design service provider in southwest China, the revenue of Zhongtai design from 2019 to 2021 was 0.351 billion yuan, 0.392 billion yuan and 0.413 billion yuan respectively, and the net profit attributable to shareholders of the parent company was 0.052 billion yuan, 0.07 billion yuan, 0.075 billion yuan, the balance of accounts receivable is 0.2 billion yuan, 0.27 billion yuan and 0.368 billion yuan respectively.

Excessive Accounts receivable may become one of the main reasons for its termination of IPO. According to the prospectus of China-Thailand design, during the reporting period, the top five customers designed by China-Thailand were rongchuang, Evergrande, Peking University resources, noshida and German merchants. Among them, by the end of 2021, the balance of receivables designed by China and Thailand to Evergrande was 32.2919 million yuan, and the receivables that had fully accrued bad debt reserves were 28.564 million yuan.

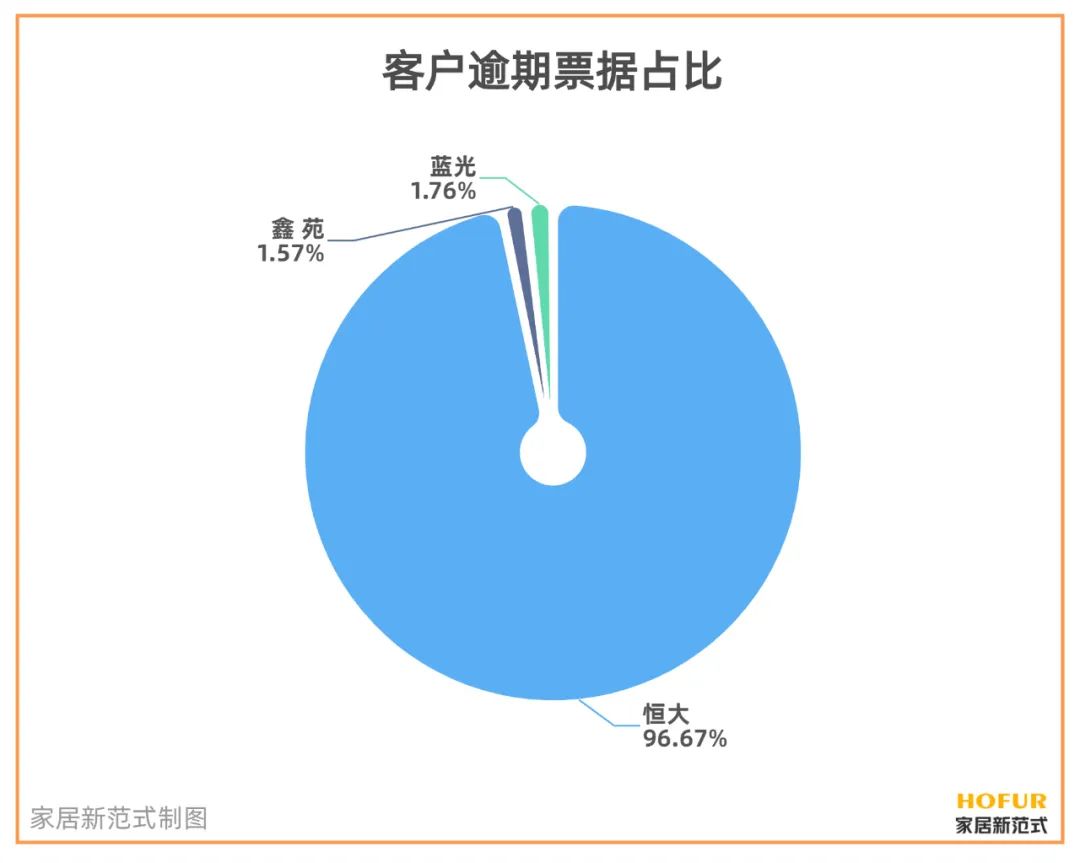

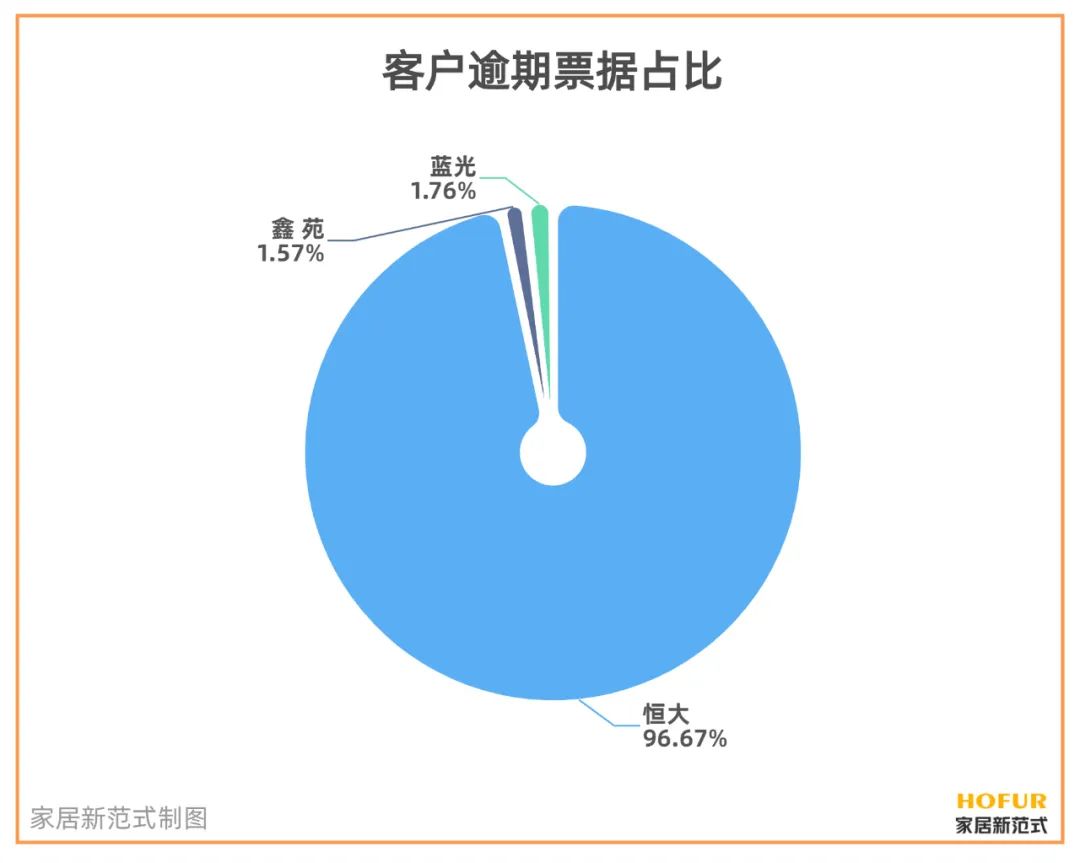

Meanwhile, the balance of Bills receivable of the top five clients designed by China and Thailand is 43.9476 million yuan, of which rongchuang accounts for nearly 47.6% and Evergrande accounts for 21.4%. Among the overdue bills, as of the end of last year, the overdue bills designed by China and Thailand were as high as 18.14 million yuan, of which Evergrande was 17.5351 million yuan overdue, accounting for nearly 97%.

In fact, more than one company was designed by China and Thailand due to the impact of real estate thunder on the listing progress. The operating performance of the listed architectural design enterprises in 2021 is not optimistic. Take Golden Mantis, Guangtian group and Baoying shares as examples. In 2021, three enterprises lost 4.95 billion yuan, 5.588 billion yuan and 1.652 billion yuan respectively.

Home decoration industry under real estate Thunder

the debt situation of Evergrande is the main reason for "dragging down" profits. As of December 31, 2021, the accounts receivable and notes receivable of Gold Mantis, Guangtian group and Baoying shares to Evergrande totaled more than 18.1 billion yuan.

By the end of 2021, the total exposure of Gold Mantis company to Evergrande's receivables (including Accounts receivable, Bills receivable and contract assets, etc.) totaled 8.654 billion yuan, and accumulated various impairment losses of 6.104 billion yuan, the net exposure of receivables is 2.551 billion yuan.

By the end of 2021, the book balance of accounts receivable and bills receivable of Guangtian group to Evergrande and its subsidiaries totaled 7.698 billion yuan, and the bad debt reserves totaled 3.849 billion yuan.

By the end of 2021, the total amount of accounts receivable transferred by Baoying shares to Evergrande group at the end of the period was 1.749 billion yuan, of which 0.852 billion yuan was overdue and amount of instrument yuan was overdue, amount of instrument yuan was overdue. On April 25, 2022, Baoying shares also put the book value of commercial acceptance bills and accounts receivable issued by a major client and its member enterprises in its possession at 2.387 billion yuan, according to 1.193 billion yuan as capital contribution assets, Zhuhai Jianying will be increased.

Since 2022, 6 pottery enterprises have filed lawsuits against 27 housing enterprises, including sales contract disputes, Bill recourse disputes, etc. The litigation targets are mainly regional leading housing enterprises. Affected by the debt of housing enterprises, some pottery enterprises even become the litigation objects of downstream suppliers.

In the face of the real estate Thunder crisis, some ceramic industry insiders mentioned, "I think the sooner the 'explosion' is, the better." "From the perspective of the industry, after the storm of housing enterprises, it is conducive to the subsequent cooperation and the re-standardization and rationalization of the rules of the game. From the perspective of material suppliers, we will still embrace this industry in the later period, but we will embrace it in a more positive, rational and compliant way."