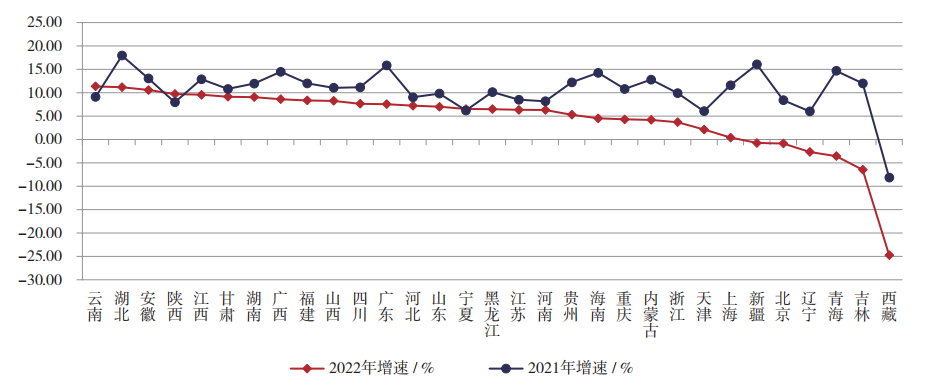

1. Jiangsu led the country with absolute advantage total output of building industry, with rapid growth in Yunnan, Hubei and Anhui

In 2022, jiangsu total output of building industry exceeded 4 trillion yuan for the first time, reaching 4066.005 billion yuan, and continued to lead the country with absolute advantage. The total output of building industry of Zhejiang, Guangdong and Hubei provinces also exceeded 2 trillion yuan, ranking second, third and fourth. Total output of building industry in 4 provinces accounted for 34.82 percent of the national total output of building industry. In addition to these four provinces, 10 provinces and cities with a total output value of more than 1 trillion yuan are Sichuan, Shandong, Fujian, Henan, Hunan, Beijing, Anhui, Jiangxi, Chongqing and Shaanxi, the total output of building industry completed in the above 14 regions accounted for of the national total output of building industry (figure 1).

Figure 1 ranking of total output of building industry in different regions of China in 2022

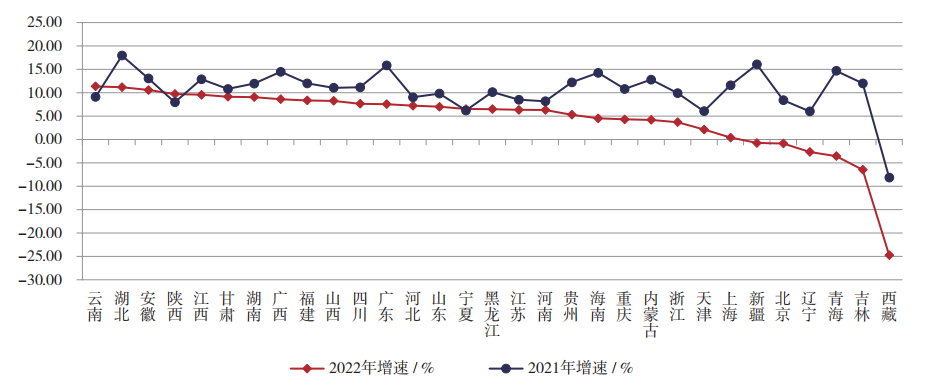

Judging from the growth of total output of building industry in each region, 25 regions have maintained growth total output of building industry, with yunnan, hubei and anhui ranking the top three with the growth rates of 11.34%, 11.16% and 10.57% respectively; Xinjiang, beijing, liaoning, Qinghai, Jilin and Tibet experienced a decline in total output of building industry, with Tibet declining by nearly 25% (Figure 2).

Figure 2 total output of building industry growth rate by region from 2021 to 2022

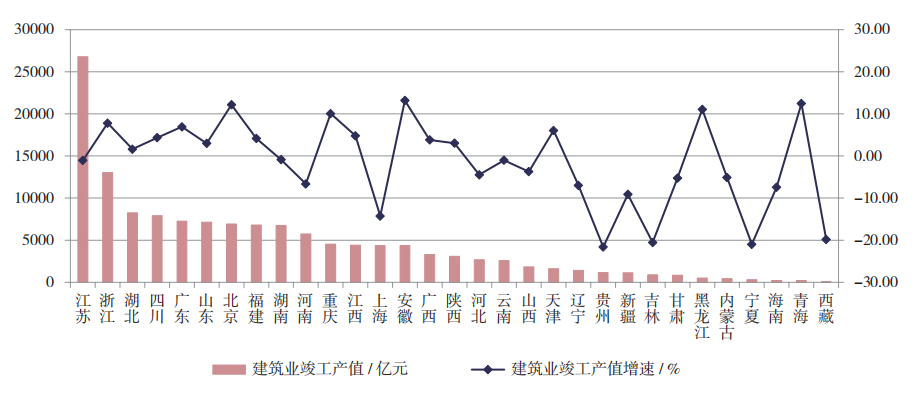

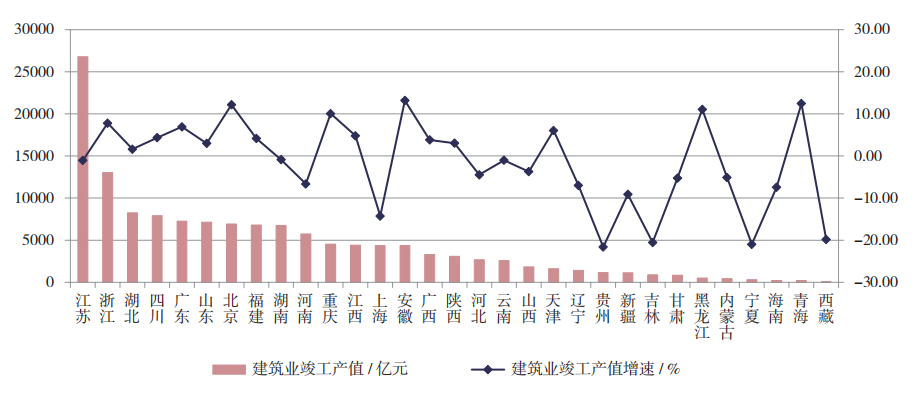

Second, the finished output value of Jiangsu construction industry continues to maintain a large advantage, and the finished output value of construction industry in 16 regions shows negative growth.

In 2022, Jiangsu construction industry achieved a completed output value of 2677.372 billion yuan, which was 1.07 percent lower than that of the previous year, still ranking first. Zhejiang construction industry achieved a finished output value of 1303.178 billion yuan, an increase of 7.79 percent over the previous year, ranking second. The completed output value exceeds 5~0 billion yuan in 8 regions including Hubei, Sichuan, Guangdong, Shandong, Beijing, Fujian, Hunan and Henan. The growth rate of completed output value exceeded 10% in five regions including Anhui, Qinghai, Beijing, Heilongjiang and Chongqing. The completed output value in 16 regions showed negative growth, including Jilin, Ningxia, the decline in Guizhou is over 20% (figure 3).

Figure 3 completed output value and growth rate of construction industry in different regions in 2022

3.22 regions have achieved output growth in other provinces, with Yunnan and Ning growing by more than 20%

In 2022, the top two output values completed in other provinces were still Jiangsu and Beijing, which were 17 to 90.4 billion yuan and 1007.536 billion yuan respectively. The sum of the output value completed by the two regions in other provinces accounts for of the total output value completed in other provinces. In Hubei, Fujian, Zhejiang, Shanghai and Guangdong, the output value in other provinces all exceeded 500 billion yuan. Judging from the growth rate, the output value of 22 regions has maintained growth in other provinces, and the growth rates of Yunnan and Ningxia both exceed 20%. The output value of 9 regions has declined in other provinces, and Tibet has seen a negative growth of nearly 57%.

From the perspective of outward orientation (that is, the proportion of the construction industry output value completed by the region in other provinces accounts for total output of building industry of the region), the top three regions are still beijing, tianjin and shanghai, with 72.66 percent respectively, 65.72% and 62.30%. There are 11 regions in fujian, jiangsu, hubei, qinghai, shaanxi, shanxi, liaoning, hebei, inner mongolia, hunan and jiangxi with an outward degree of more than 30%. There are 17 regions with negative outward growth, among which Tibet, Heilongjiang, Gansu and Zhejiang all have a decline of more than 10% (Figure 4).

Figure 4 total output of building industry and outward orientation completed by regions across provinces in 2022

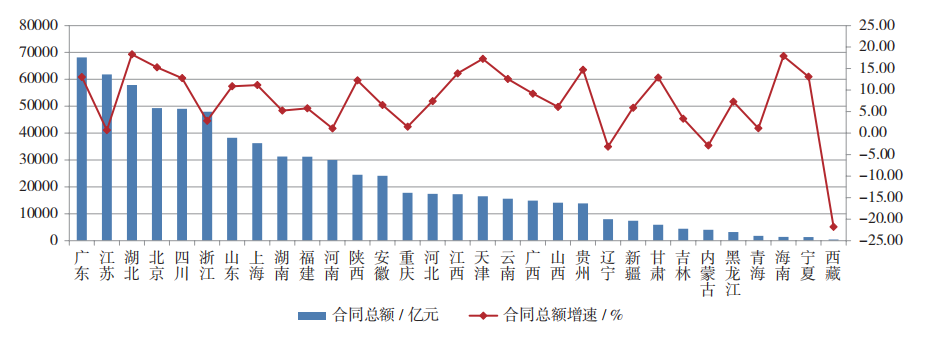

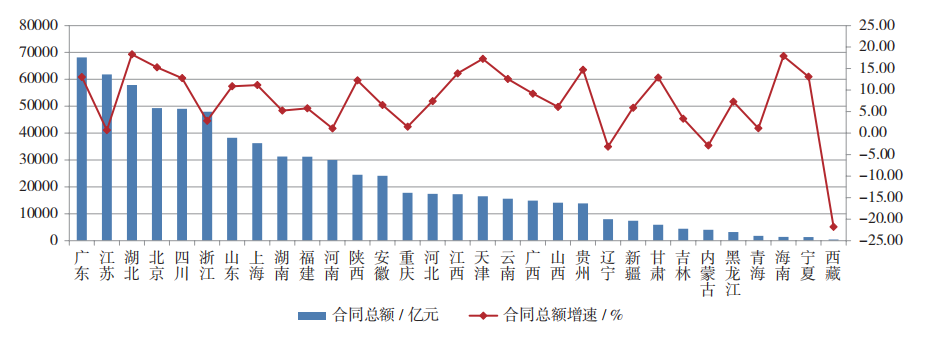

IV. The total amount of contracts signed by Guangdong surpassed Jiangsu, with negative growth in Tibet, Liao and Mongolia.

In 2022, the total amount of contracts signed by guangdong construction enterprises surpassed jiangsu to occupy the first place, reaching 68,13.379 billion yuan, an increase of 13.06% over the previous year; Jiangsu construction enterprises fell to the second place with 61,85.885 billion yuan, A slight increase of over the previous year. The total amount of contracts signed by the two provinces accounted for of the total amount of contracts signed nationwide. There are also nine regions with a total contract of more than 3 trillion yuan in Hubei, Beijing, Sichuan, Zhejiang, Shandong, Shanghai, Hunan, Fujian and Henan. The number of contracts signed by 28 regions increased over the previous year. The growth rate exceeded 10% in hubei, hainan, tianjin, beijing, guizhou, jiangxi, ningxia, guangdong, gansu, sichuan, yunnan, shaanxi, 14 regions in Shanghai and Shandong, three regions in Tibet, Liaoning and Inner Mongolia signed contracts with negative growth (figure 5).

Figure 5 contract amount and growth rate signed by construction enterprises in various regions in 2022

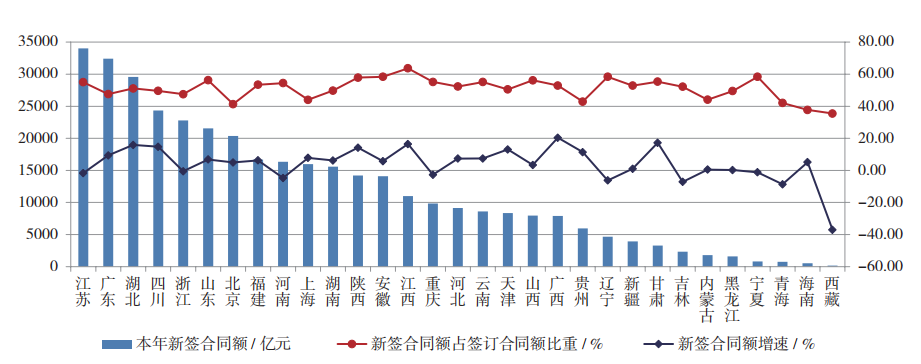

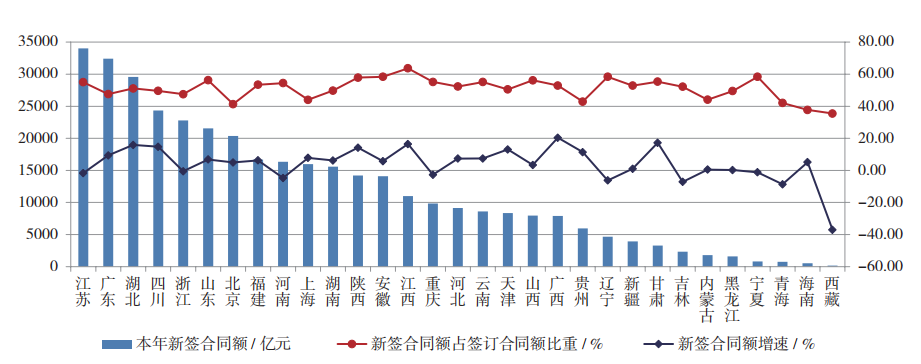

V. The contract amount signed by Su and Guangdong exceeded 3 trillion yuan, and the growth rate of GUI, Gan and Gan was relatively fast.

In 2022, the newly signed contracts of Jiangsu and Guangdong construction enterprises all exceeded 3 trillion yuan, reaching 3403.335 billion yuan and 3241.269 billion yuan respectively. The newly signed contract amount exceeds 1 trillion yuan in 12 regions including Hubei, Sichuan, Zhejiang, Shandong, Beijing, Fujian, Henan, Shanghai, Hunan, Shaanxi, Anhui and Jiangxi. The growth rate of newly signed contracts exceeded 10% in 8 regions including Guangxi, Gansu, Jiangxi, Hubei, Sichuan, Shaanxi, Tianjin and Guizhou, Tibet, Qinghai, Jilin, Liaoning, Henan, Chongqing, the newly signed contracts in 9 regions of Jiangsu, Ningxia and Zhejiang showed negative growth (figure 6).

Figure 6 the newly signed contract amount and growth rate of construction enterprises in different regions in 2022

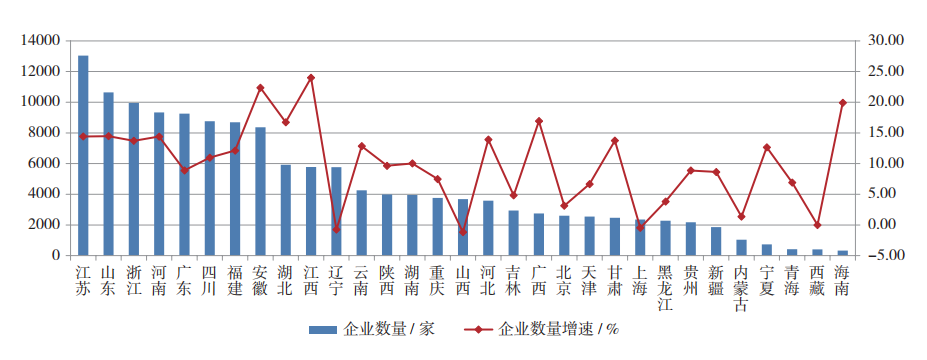

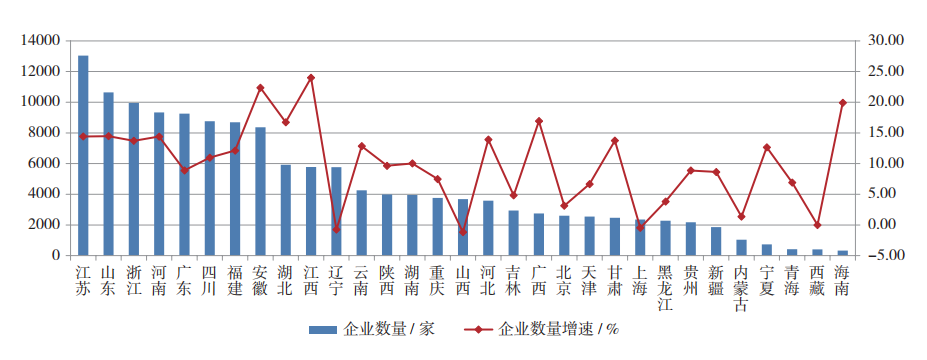

VI. The number of construction enterprises in Su and Lu exceeded 10000, with negative growth in Jin, Liao and Shanghai.

In 2022, the number of construction enterprises in Jiangsu and Shandong both exceeded 10000, reaching 13040 and 10643 respectively. There are 9 regions with more than 5,000 enterprises in Zhejiang, Henan, Guangdong, Sichuan, Fujian, Anhui, Hubei, Jiangxi and Liaoning. The growth rate of the number of enterprises exceeds 15% in Jiangxi, Anhui, Hainan, Guangxi and Hubei. The number of enterprises in Shanxi, Liaoning and Shanghai showed negative growth, while the number of enterprises in Tibet was the same as that in the previous year (Figure 7).

Figure 7 number and growth rate of construction enterprises in different regions in 2022

VII. The number of employees in 23 regions decreased, and the labor productivity in 21 regions increased.

In 2022, there were still 15 areas with more than one million employees in the construction industry nationwide. The number of employees in Jiangsu ranks first, reaching 8.7723 million. Zhejiang, Fujian, Sichuan, Guangdong, Henan, Shandong, Hunan, Hubei and Anhui all have more than 2 million employees.

Compared with the previous year, the number of employees in 8 regions increased, among which, the number of employees in Anhui increased by more than 150000, and the number of employees in Ningxia increased by more than 130000; The number of employees in 23 regions decreased, among which, zhejiang reduced 440400 people, Hunan reduced 174800 people, Guangdong reduced 101300 people. Ningxia ranked first with the growth rate of 122.27 percent of the number of employees; The number of employees in Tibet, Liaoning and Inner Mongolia all declined by more than 10 percent (Figure 8).

Figure 8 The number of employees in construction industry and its growth in each region in 2022

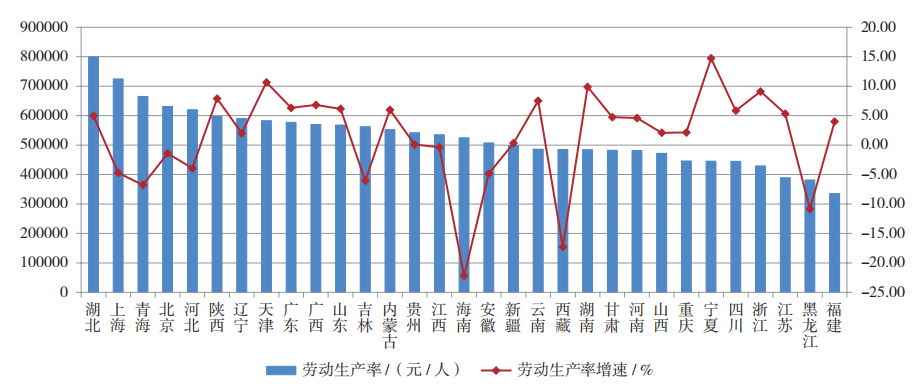

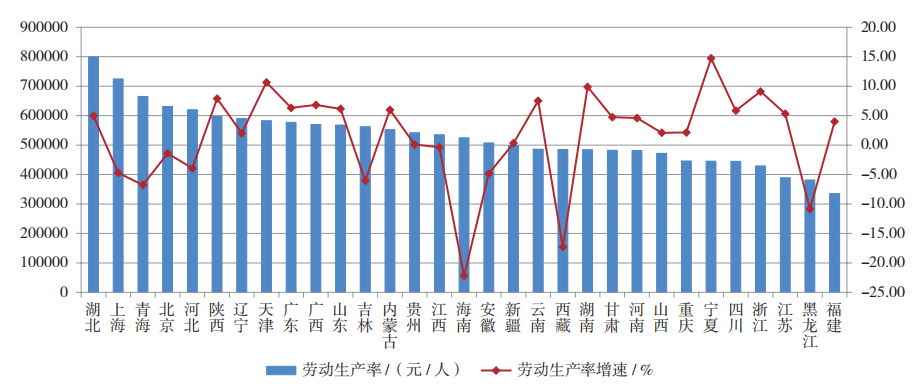

In 2022, the top three regions ranked by labor productivity calculated by total output of building industry were still Hubei, Shanghai and Qinghai. Hubei is 799 to 201 yuan/person, an increase of 4.97% over the previous year; Shanghai is 724 to 666 yuan/person, a decrease of 4.73% over the previous year; Qinghai is 665033 yuan/person, this is 6.78 percent lower than the previous year. Labor productivity has increased in 21 regions, with Ningxia and Tianjin growing by more than 10%. Labor productivity has decreased in 10 regions, Hainan, Tibet, the decline in all three regions of Heilongjiang exceeded 10% (Figure 9).

Figure 9 labor productivity in building industry and growth of each region in 2022

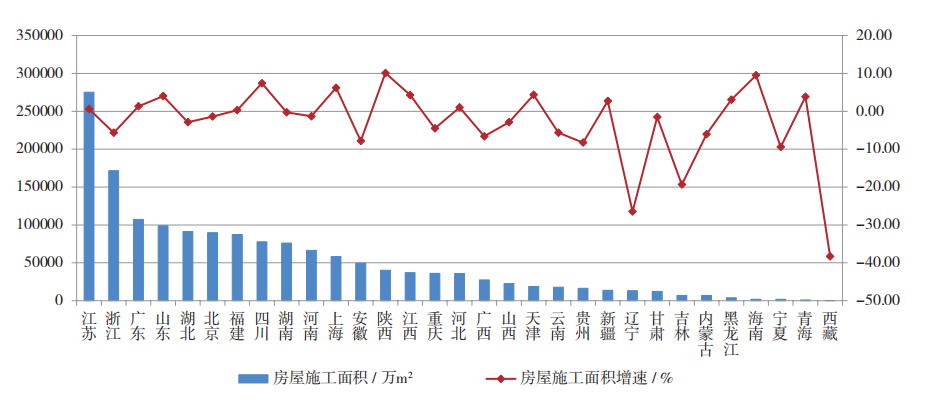

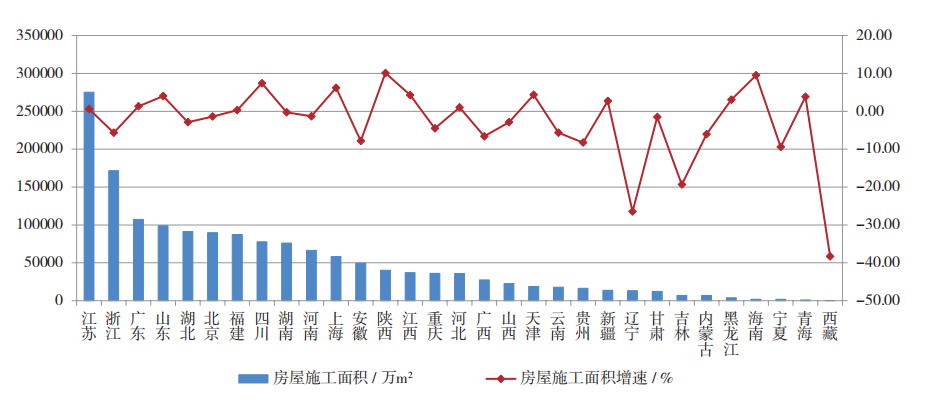

The construction area of houses in 17 regions decreased, and the completed area of houses in 19 regions decreased.

In 2022, Jiangsu, Zhejiang and Guangdong construction enterprises ranked the top three in the construction area with 2.751 billion ㎡, 1.717 billion ㎡ and 1.074 billion ㎡ respectively, an increase of 0.61% over the previous year, decrease by 5.66% and increase by 1.31%. The construction area of houses in 8 regions of Shandong, Hubei, Beijing, Fujian, Sichuan, Hunan, Henan and Shanghai exceeds ㎡. The construction area of houses in 14 regions increased compared with the previous year, with Shaanxi ranking first with a growth rate of. The construction area of houses in 17 regions decreased compared with the previous year, among which Tibet, Liaoning, jilin showed a decrease of 38.30%, 26.48% and 19.35% respectively (Figure 10).

Figure 10 building construction area and growth of construction enterprises in various regions in 2022

In 2022, Jiangsu, Zhejiang and Hubei construction enterprises ranked among the top three completed building areas with 0.763 billion ㎡, 0.449 billion ㎡ and 0.333 billion ㎡ respectively, which were 1.77%, 3.72% and 0.45% higher than the previous year respectively. The construction area of houses in 10 regions of Guangdong, Hunan, Shandong, Sichuan, Fujian, Henan, Anhui, Jiangxi, Beijing and Chongqing exceeds 0.1 billion ㎡. The completion area of houses in 12 regions increased compared with the previous year, and Heilongjiang ranked first with a growth rate of. The completion area of houses in 19 regions decreased compared with the previous year, among which Tibet, Jilin, Qinghai, ningxia has experienced a decline of more than 30% (Figure 11).

Figure 11 completed building area and growth of construction enterprises in various regions in 2022

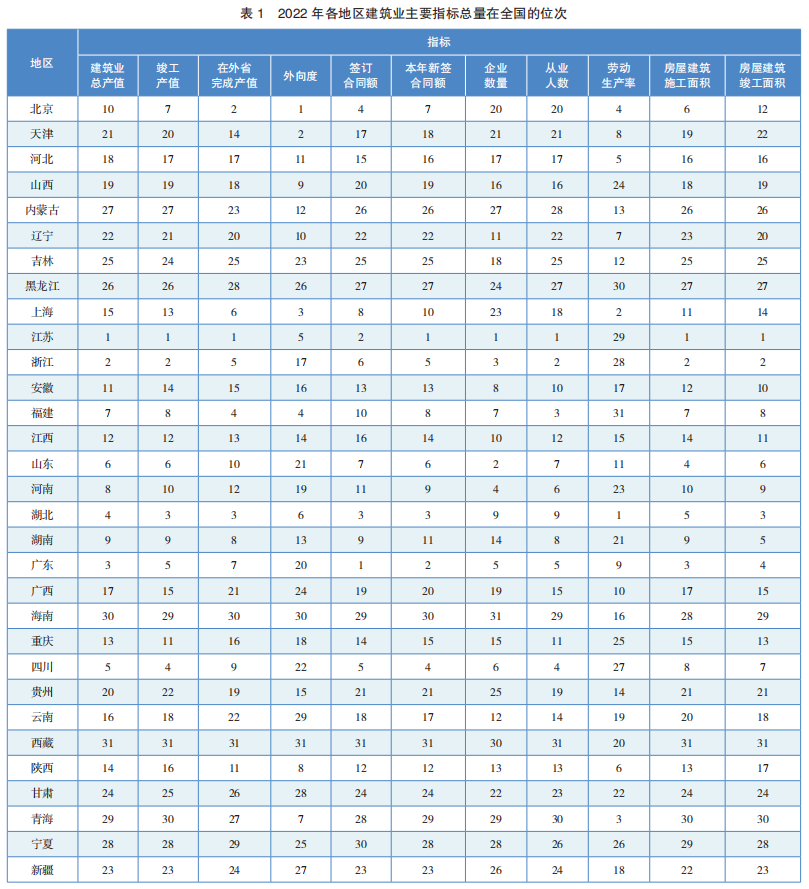

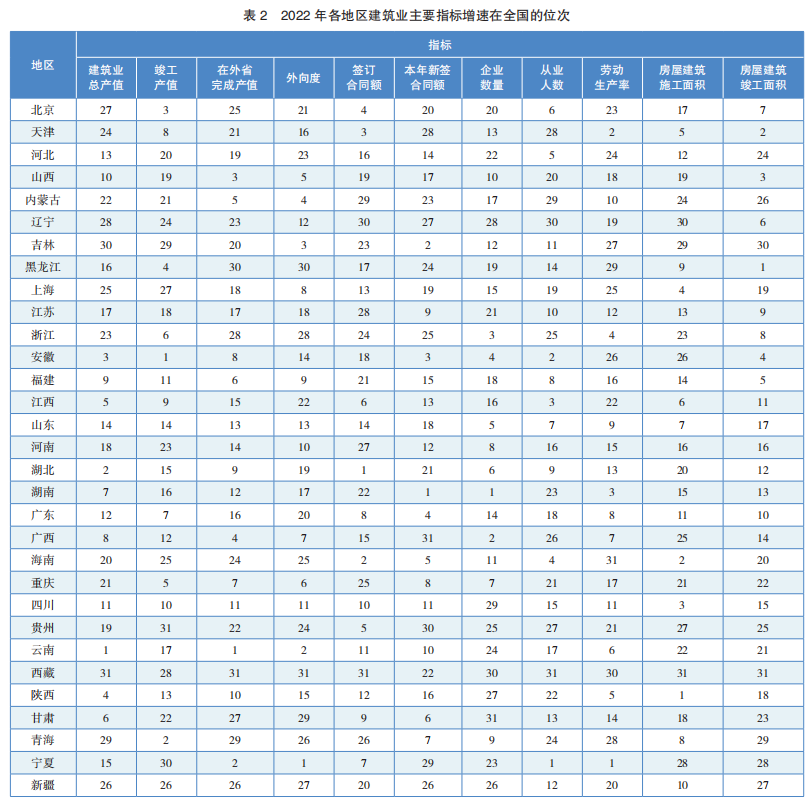

IX. The ranking of the total amount and growth rate of the main indicators of the construction industry in each region in the country

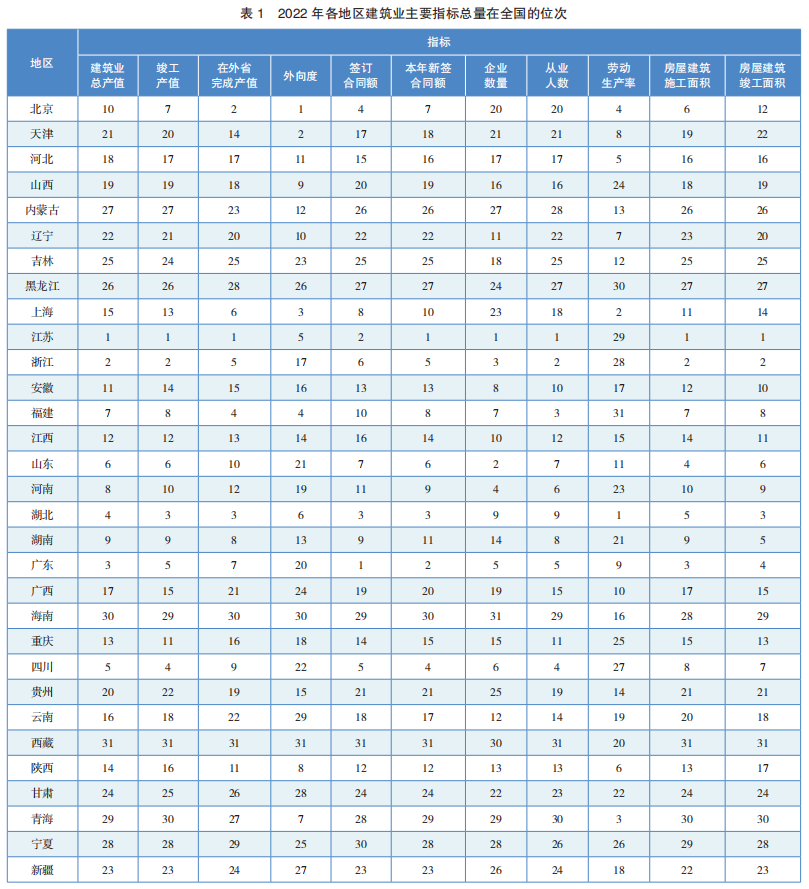

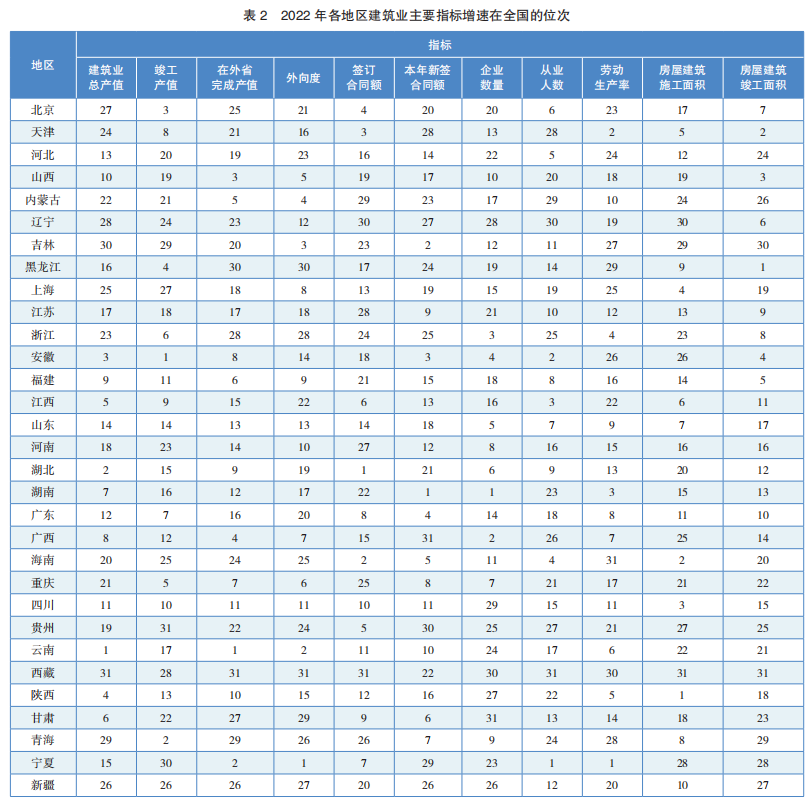

In 2022, the ranking of the total amount and growth rate of the main indicators of the construction industry in each region in the country is shown in table 1 and table 2 respectively.

Description:

All statistical data do not include Hong Kong, Macao Special Administrative Region and Taiwan province.

Data sources and references:

1. National Bureau of Statistics. Statistical Bulletin of the People's Republic of China on national economic and social development in 2022

2. National Bureau of Statistics. National data (annual data, quarterly data, regional data)

3. Ministry of Commerce. Concise Statistics of China's foreign contracted engineering business in 2022

4. Ministry of Commerce. Concise Statistics of China's foreign labor cooperation business in 2022

5. Zhang yu. Interpretation of the top 250 ENR international contractors list in 2022 [J]. Journal of engineering management, 2022,36(4):141-146.